Irs Mileage Deduction 2025. Find standard mileage rates to calculate the deduction for using your car for business, charitable, medical or moving purposes. For the 2025 tax year, standard mileage rates are:

On december 14, 2025, the internal revenue service (irs) issued the 2025 optional standard mileage rates used to calculate the deductible costs of operating an automobile. The irs medical mileage rate for 2025 is 21 cents per mile.

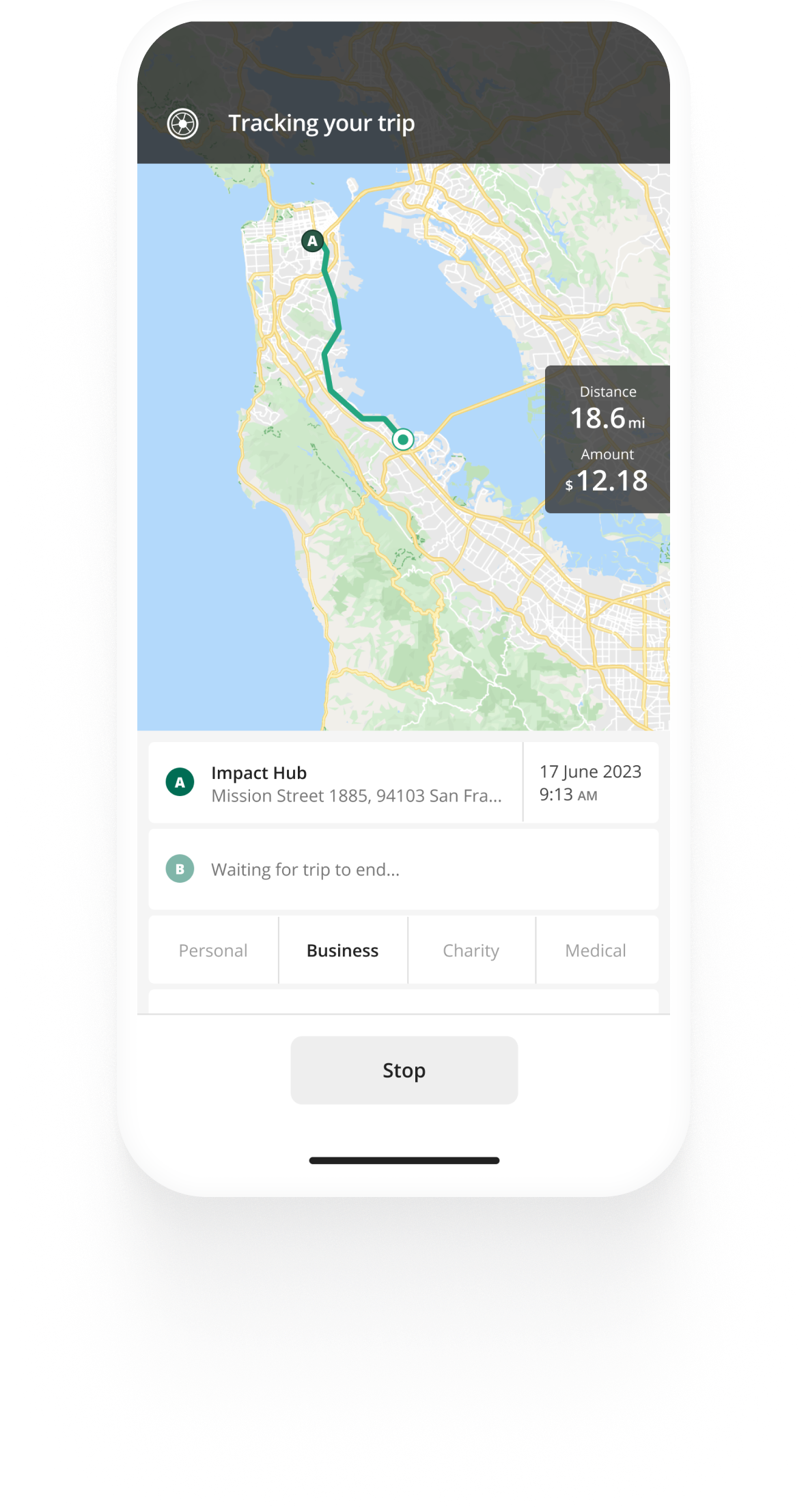

The a free irs mileage calculator is designed to help you understand your mileage deduction for 2025 or 2025.

Irs Mileage Rate 2025 Rosie Abagael, New standard mileage rates are: You can use this mileage reimbursement calculator to determine the deductible costs associated with running a vehicle for medical, charitable, business, or moving.

Irs 2025 Standard Deduction For Seniors Over 65 Joete Madelin, You can use this mileage reimbursement calculator to determine the deductible costs associated with running a vehicle for medical, charitable, business, or moving. To claim the deduction for the 2025 tax year, the vehicle must have been purchased within that calendar year.

Irs 2025 Standard Deductions And Tax Brackets Allsun Annabella, 22 cents per mile for medical or. The 2025 irs standard mileage rates are 67 cents per mile for every business mile driven, 14 cents per mile for charity and 21 cents.

2025 Tax Rates And Standard Deduction U/S Daron Ronnica, 67 cents per mile for business purposes. Mileage rate increases to 67 cents a mile, up 1.5 cents from 2025.

Irs Standard Mileage Deduction 2025 silva lorilee, Builders of energy efficient homes may qualify for a valuable tax credit. 14 cents per mile for charitable use.

IRS Mileage Deduction Rules for SelfEmployed in 2025, Mileage rate increases to 67 cents a mile, up 1.5 cents from 2025. Use the standard mileage deduction by multiplying your business miles driven by the irs's established rate for 2025.

2025 Tax Brackets And Rates carlyn madeleine, Irs issues standard mileage rates for 2025; To claim the deduction for the 2025 tax year, the vehicle must have been purchased within that calendar year.

What Is The Irs Standard Mileage Rate For 2025 Daune Eolande, New standard mileage rates are: Use the standard mileage deduction by multiplying your business miles driven by the irs's established rate for 2025.

2025 Mileage Tax Deduction Clem Melita, Use the standard mileage deduction by multiplying your business miles driven by the irs's established rate for 2025. The internal revenue service announced an increase in the standard mileage rates when people use their vehicles for business use.

Maximum Mileage Deduction 2025 Rene Wandis, The irs medical mileage rate for 2025 is 21 cents per mile. Use the actual expenses method by.

Porsche 718 Boxster Gts 4.0 2025. $100 rebate on select mickey thompson tires expires 07/16/2025. […]

Panamera 2025 Enginesod. Detailed specs and features for the 2025 porsche panamera including dimensions, horsepower, […]